The UK property market is once again in the spotlight, this time following significant political changes at the top of the Labour Party. Sir Keir Starmer's reshuffle of his economic team has introduced new uncertainty just as the country prepares for the Autumn Budget.

This shift raises key questions about the direction of fiscal policy and the authority of Chancellor Rachel Reeves — all of which could have direct implications for buyers, sellers, and property investors.

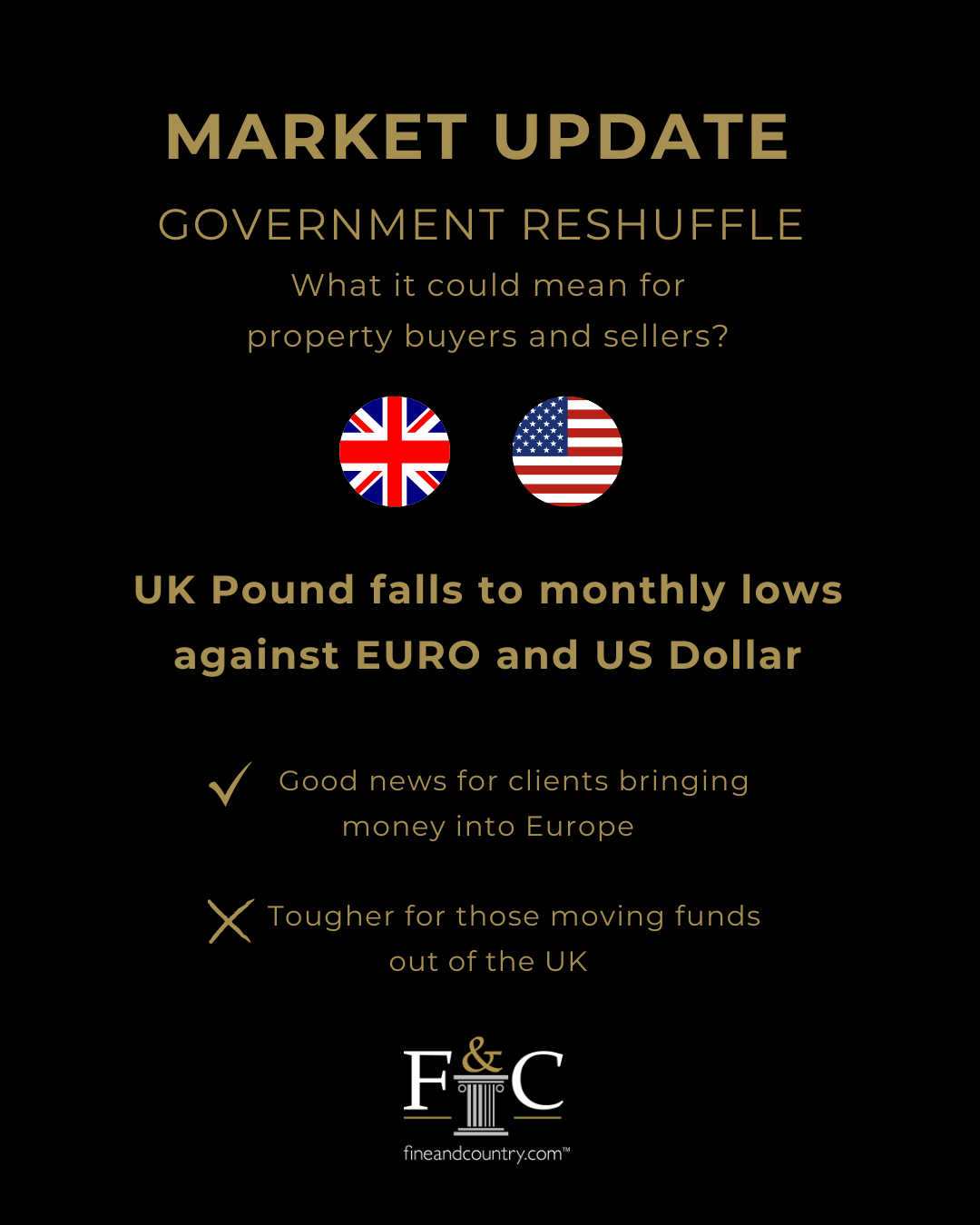

The Pound Has Fallen

One of the immediate effects of the reshuffle has been a sharp drop in the value of the pound. In recent days:

- The pound fell 1.2% against the US dollar

- It dropped 0.6% against the euro

For clients transferring funds internationally, this movement matters. Those bringing money into the UK or Europe may benefit from improved exchange rates, while those moving funds out of the UK will face reduced buying power.

Political Moves and Market Reactions

Markets are showing signs of unease. The timing of the reshuffle, so close to the Autumn Budget, has increased speculation about potential changes to fiscal policy. Among the key concerns:

- Possible increases to Capital Gains Tax or changes to Stamp Duty

- Higher borrowing requirements

- Whether the government can balance spending with economic stability

At the same time, long-term UK borrowing costs have spiked. Thirty-year gilt yields have risen to levels not seen since 1998, a signal that mortgage rates could also begin climbing again.

Implications for Buyers and Sellers

The property market is particularly sensitive to changes in interest rates and fiscal policy. For buyers and sellers, the government reshuffle could mean:

- Increasing mortgage costs, affecting affordability and borrowing power

- Shifts in property tax policies, impacting investment strategies

- Currency risk for international transactions requiring careful timing and planning

In a market that thrives on stability, political uncertainty tends to have a chilling effect on activity and sentiment.

Final Thoughts

Political developments are once again driving volatility in the UK property market. The recent government reshuffle has raised more questions than answers, particularly for those planning property purchases, sales, or investments in the near future.

This is a critical moment to reassess your financial strategy, consider the impact of currency movements, and review your timelines. Staying informed and proactive will be key as we approach a potentially transformative Autumn Budget.