Residential Sales Market Report - September 2025

Steady levels

The housing market enters autumn with easing borrowing costs helping support steady levels of demand. House price growth remains modest, though policy developments could temper these trends in the months ahead.

Market outlook

Interest rates have now been cut five times since last August, with the Bank of England’s latest move lowering the base rate to 4%, its lowest level in more than two years¹. The decision, reached after a split vote in which five MPC members backed the cut and four preferred to hold, has helped boost buyer and seller confidence. However, sticky inflation and economic data have added uncertainty over the pace of further reductions, with inflation rising 3.8% in the 12 months to July 2025, the highest level since January 2024 and well above the Bank’s 2% target¹.

Reform rumours

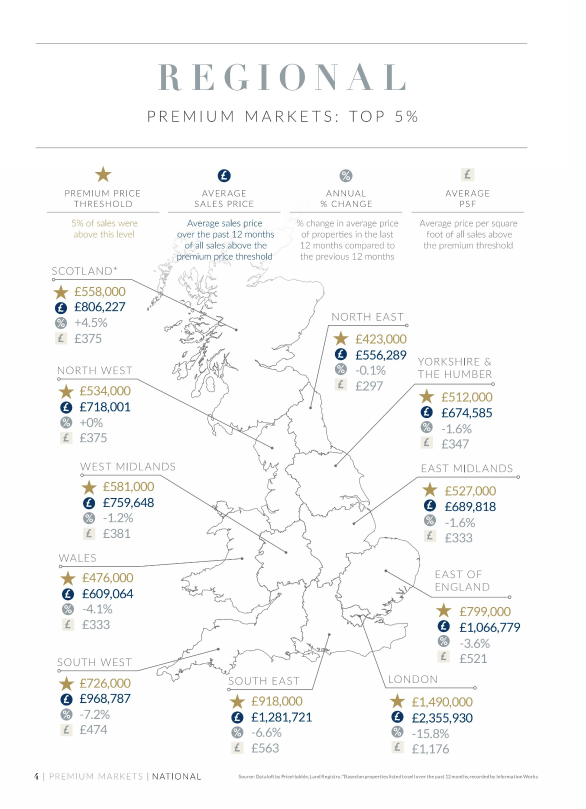

At the same time, speculation over housing tax reform ahead of the Autumn Budget is creating fresh uncertainty. Proposals under discussion include scrapping stamp duty and replacing it with an annual levy on homes above £500,000, paid by sellers rather than buyers, extending Capital Gains Tax to main residences, and introducing a charge on properties worth over £1.5 million. First-time buyers and those moving up the property ladder could be affected differently depending on property values and location, with London and the South East likely to feel the biggest impact. While these measures remain at the proposal stage, the possibility of change alone risks dampening activity in the short to medium term.

Price it right

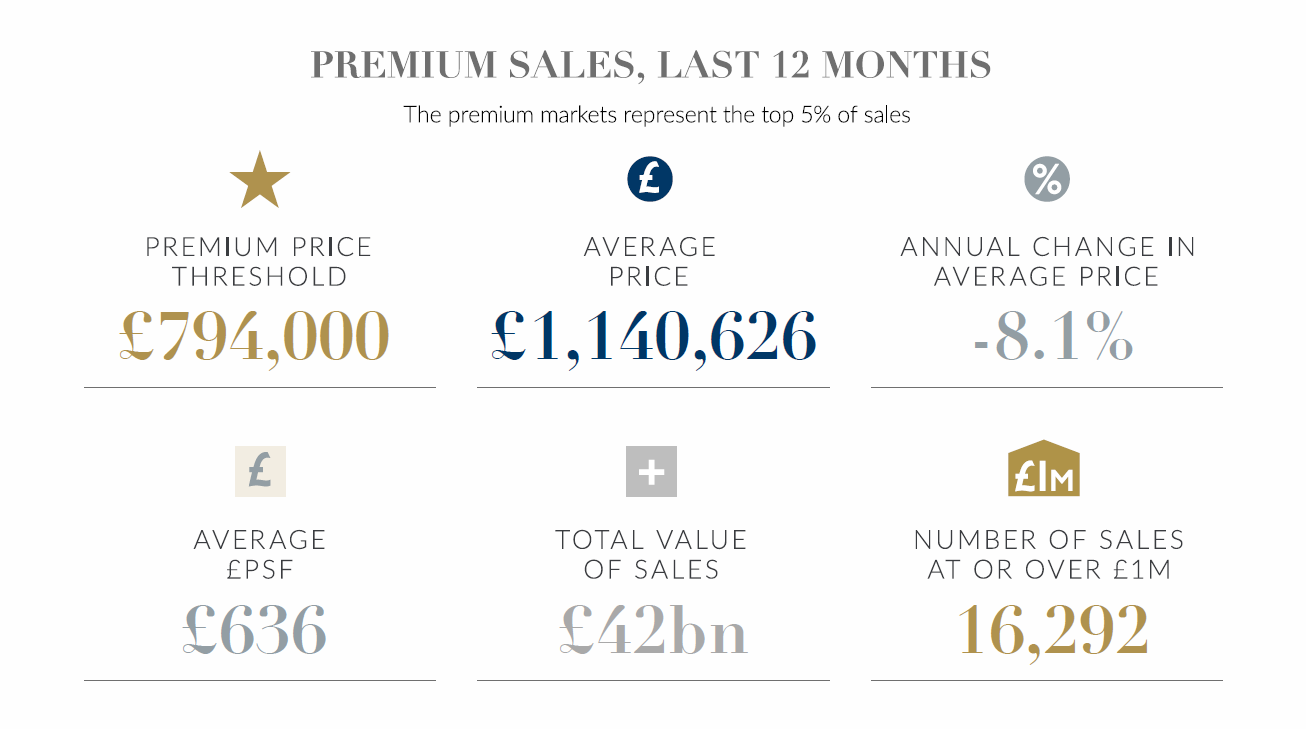

August saw a slight softening in the rate of annual house price growth to 2.1%, from 2.4% in July². Buyers have the upper hand in this high-supply market, so getting the price right is becoming increasingly important. On average, homes needing a price cut take 2.4 times longer to secure a buyer than those priced correctly from the outset³. Across the prime markets of England and Wales, the average price of a property is £1,140,626, down -8.1% compared to the same time last year.

Continued momentum

With affordability still stretched, gradual improvements from stronger income growth and easing borrowing costs are helping support buyer demand. There were 65,352 mortgage approvals recorded in July, the third consecutive monthly increase and up 4.6% year-on-year¹. Market activity also held firm over the typically slower summer months, as residential property transactions rose 4% year-on-year in July and stood 5% above the five-year average4. Activity levels typically pick up in autumn as schools restart and moving plans regain focus. From 2021–2024, asking prices rose an average 0.6% between August and September5, and this year’s steady summer sales point to continued momentum, though policy developments could impact these trends in the months ahead.

School Catchments

Rising private school fees and new VAT rules are reshaping household choices, with parents increasingly willing to pay a premium for state school catchments. New research from Santander UK shows nearly three-quarters of parents (73%) would pay extra to live near a top-performing school, up 11% on last year6. On average, families are prepared to pay 15% more, with one in ten willing to pay more than 25%, and to move as far as 31 miles, nine miles further than a year ago6.

¹Bank of England, ²Nationwide, ³Zoopla, 4HMRC , 5PriceHubble, Rightmove, 6Santander UK

Has your property's value increased? To find out how much your property is worth

BOOK A PROPERTY VALUATION